Innovation Growth Engines

In recent years, the technology sector has been one of the main investment channels. Private individuals and organizations exponentially increased their consumption and use of technology. Over the past year, we saw that the sector remained relatively stable during the COVID-19 crisis as well, and also showed growth, even bucking the general trend. The COVID-19 crisis led to significant digital acceleration, at an unprecedented pace. “We’ve seen two years’ worth of digital transformation in two months,” said Microsoft CEO, Satya Nadella, in the first quarter of the COVID-19 crisis.

The growth engines in innovation, including technology, are numerous and diverse, including green energy, gaming, fintech, cloud services, cyber, online trading, autonomous vehicles, internet and communications, remote medicine and more.

Technology is here to stay

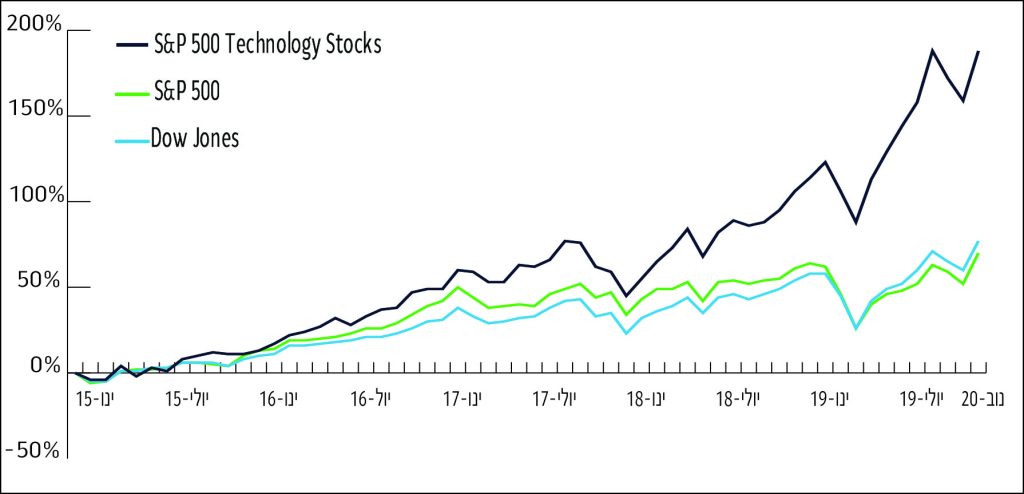

The digital transformation has made its mark on large companies that are undergoing processes to streamline technology and on private individuals who are benefiting from the progress and numerous possibilities technology offers, and by doing so they increase the demand for the full array of products and services that did not exist before. The success of technology that we experience is also reflected in the stock markets. We can see that over the past decade, the technology indices have outperformed other indices. S&P 500, Dow Jones, Tel Aviv 125, Tel Aviv 35 and other indices underperformed compared to the technology index, a trend that has been particularly clear over the past year.

Comparison between the technology index and the S&P 500 and Dow Jones indices in recent years

The index refers to November 30, 2015-November 30, 2020

graf

Data source: yahoo finance, processed by: IBI Investment House

Manner of investment in IBI Innovation portfolio

As part of effective investment management, with the help of the Research Department, analysis of IBI Portfolio Management and the work with large investment houses around the world, we choose the investment channels that are right for you, while diversifying the investments in various sectors and geographies. Furthermore, you choose whether to invest in shekels or in foreign currency. Additionally, you can invest through the IRA platform.

Below is an illustration of sectoral and geographic exposure. Given that by its very nature, the investment portfolio is dynamic, the weights presented do not obligate the portfolio manager, and they may change the weights of the sectors and the various geographies over time.

IBI Portfolio Management’s International Investment Department

Zvika Shlezinger, manager of IBI Portfolio Management’s International Investment Department, has over 20 years of experience in international investment management and with foreign securities. Working side-by-side with Zvika are additional investment managers, analysts and traders with extensive experience with investments and trading on international markets.

We at IBI Investment House believe in creativity alongside responsibility when managing investments. Join thousands of people who have chosen us for decades to manage their money in advance investment products.